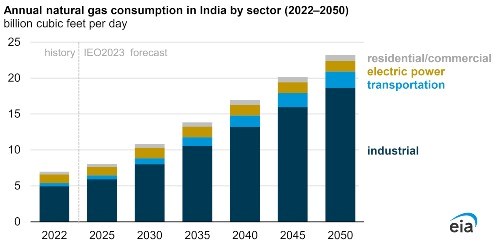

Industry to drive tripling of natural gas consumption in India by 2050

Data source: U.S. Energy Information Administration, International Energy Outlook 2023 (IEO2023)

In EIA's International Energy Outlook 2023, it was projected that natural gas consumption will more than triple in India by 2050 with an annual growth of 4.4% over that period, more than twice the 2.0% annual growth rate of natural gas consumption in China, the next-fastest-growing country.

We project that India’s industrial sector—in particular, ammonia production intended to decrease fertilizer imports—as well as a growing oil refining sector will drive most of the growth in natural gas consumption over the projection period. This growth in demand will require more significant increases in India's domestic natural gas supply and imports than in recent years. According to the International Energy Agency, India’s domestic natural gas production increased 2.4% annually on average between 2019 and 2022 as imports declined 1.5% annually.

In 2022, 7.0 billion cubic feet per day (Bcf/d) of natural gas was consumed across the residential, commercial, industrial, transportation, and electric power sectors. In 2022, the industrial sector accounted for more than 70% of total consumption, followed by the electric power sector at 17%. By 2050, we project natural gas consumption to rise in India to 23.2 Bcf/d. Among India’s five consuming sectors, we project the industrial sector’s share of natural gas consumption will grow the most, rising to 80% of total consumption, followed by the transportation sector rising to 10%.

In 2022, about half of the natural gas consumption in India’s industrial sector was used to produce basic chemicals, mostly ammonia for fertilizer. The Indian government’s stated policy to develop self-sufficiency in the production of urea, a nitrogenous fertilizer produced from ammonia, drives much of our projected increase in natural gas demand. Natural gas is a key input for urea production.

We also expect natural gas consumption in oil refining to grow significantly to keep up with India’s domestic demand for refined oil products. Between 2022 and 2050, we project that natural gas consumption will grow by more than 250% for the production of basic chemicals and by more than 400% for refining. We expect the two industries together to account for approximately 79% of India’s industrial natural gas demand in 2050.

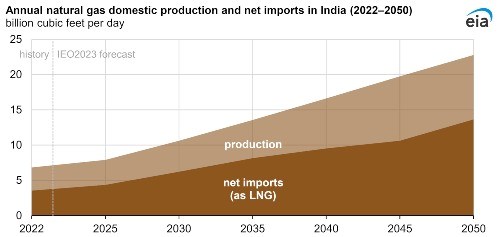

We project that both India’s domestic natural gas production and natural gas imports will help meet the growth in consumption of natural gas in India. We project domestic natural gas production to nearly triple in India from 3.3 Bcf/d in 2022 to 9.1 Bcf/d in 2050, a 3.7% average annual increase. We expect India’s net natural gas imports to grow even faster than domestic production, increasing from 3.6 Bcf/d in 2022 to 13.7 Bcf/d in 2050, a 4.9% average annual increase.

Data source: U.S. Energy Information Administration, International Energy Outlook 2023 (IEO2023)

Note: LNG=liquefied natural gas.

India’s geography heavily affects access to both its natural resources and to its natural gas imports. India does not import natural gas via pipeline, partially due to the deserts and mountains forming much of its northern border. As a result, domestic production and liquefied natural gas (LNG) imports remain the primary sources of India’s natural gas supply. Most domestic production in India, about two-thirds in 2019, is from offshore production fields. India uses a complex pipeline infrastructure to link offshore natural gas production and LNG imports that arrive at coastal import terminals to the rest of the country. Because LNG and domestic production share similar geographical constraints, our projected split of India’s natural gas supply coming from net imports and domestic production is heavily affected by the cost and availability of the two supply options.

Related News

Related News

- Credit Agricole says it will not fund two major LNG projects

- Aramco awards $7.7-B contracts to add 1.5 Bscfd of raw gas to Fadhili Gas Plant

- Japan's JERA suspends output at 4 gas-fired power plants to secure LNG stocks

- Shareholders’ Resolution: MOL to pay $668-MM dividend

- TotalEnergies: Papua LNG project requires 'more work' to reach final investment decision

- Technip Energies awarded a major LNG contract for the North Field South Project by QatarEnergy

- Shell publishes Energy Transition Strategy 2024

- QatarEnergy to charter 19 new LNG vessels expanding fleet further

- Aramco awards $7.7-B contracts to add 1.5 Bscfd of raw gas to Fadhili Gas Plant

- Mabanaft announces successful acquisition of WESTFA Energy GmbH

Comments