LNG to lead U.S. natural gas exports

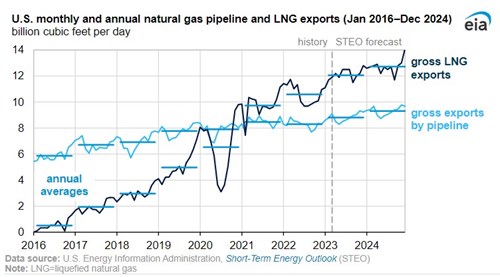

Exports of liquefied natural gas (LNG) will continue to drive growth in U.S. natural gas exports over the next two years, according to the U.S. EIA's recently released Short-Term Energy Outlook (STEO).

The EIA's March STEO forecasts that U.S. LNG exports will average 12.1 Bft3d in 2023, a 14% (1.5 Bft3d) increase compared with last year. The EIA expects LNG exports to increase by an additional 5% (0.7 Bft3d) next year.

The organization forecasts U.S. LNG exports to rise because of high global demand as LNG will continue to displace pipeline natural gas exports from Russia to Europe. So far this year, mild winter temperatures and fuller-than-average storage resulted in reduced LNG prices, which could be an incentive to import more LNG, especially in the price-sensitive countries of Southeast Asia. The Freeport LNG export terminal's return to service and the new LNG export projects that will commissioned by the end of 2024 support our forecast increase in exports.

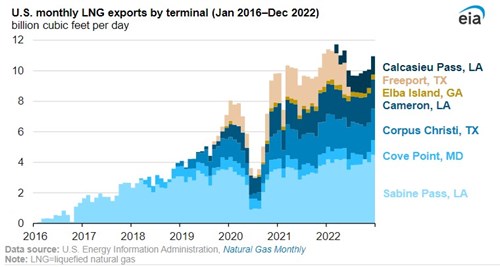

The Freeport LNG terminal is one of seven U.S. LNG export facilities; it can produce 2.14 Bft3d of LNG on a peak day. Prior to the full shutdown of the facility in June 2022, exports from the facility averaged 1.9 Bft3d from January 2021 through May 2022, according to our the EIA's Natural Gas Monthly.

Because of the Freeport shutdown, U.S. LNG exports declined to an average 10 Bft3d from June 2022 through December 2022, after peaking at 11.7 Bft3d in March. When the new Calcasieu Pass LNG export facility was commissioned, it partially offset the decline in exports from Freeport LNG; exports from Calcasieu Pass have averaged 1.2 Bcf/d since June 2022.

This year, once all three trains at Freeport LNG return to service, the EIA forecasts U.S. LNG exports to exceed 12 Bft3d, and the United States will remain the world's largest LNG exporter. The EIA forecasts that U.S. LNG exports will increase further, to approximately 14 Bft3d, by December 2024 because some LNG export projects under construction are expected to start operations by then.

The EIA expects U.S. natural gas exports by pipeline to grow by 0.5 Bft3d in both 2023 and 2024, mainly because of increased exports to Mexico. Several new pipelines in Mexico—Tula-Villa de Reyes, Guaymas-El Oro, the Mayakan pipeline on the Yucatán Peninsula, as well as some other minor interconnects—are scheduled to come online in 2023–24. The EIA also expects an increase in exports via the Sur de Texas-Tuxpan underwater pipeline to supply the proposed floating liquefaction (FLNG) project off the east coast of Mexico.

Related News

Related News

- Woodfibre LNG receives BCEAO order to move floatel to site to house non-local workforce

- QatarEnergy, Exxon seek to remove contractor from Texas gas project

- Veolia, Waga Energy and ENGIE collaborate to develop renewable natural gas industry in France

- Congo Brazzaville becomes an LNG exporting country

- Fulcrum LNG to pair with McDermott, Baker Hughes for Guyana gas project

- EU approves law to hit gas imports with methane emissions limit

- Veolia, Waga Energy and ENGIE collaborate to develop renewable natural gas industry in France

- Hawai'i Gas selects Eurus Energy America, Bana Pacific for hydrogen and renewable natural gas projects

- TotalEnergies increases LNG deliveries to Asia with two new contracts

- Desert Mountain Energy Corp. initiates helium production

Comments