Five mega-trends reshaping the global energy and resources landscape in 2025

As the energy and resources landscape undergoes rapid transformation in 2025, driven by geopolitical shifts, strategic industrial realignments and accelerating technology change, Wood Mackenzie has released five charts that spotlight the most significant trends reshaping the sector globally in its latest Horizons report.

Featured in 'Conversation starters: Five energy charts to get you talking,' offer insight into two defining macro themes: the intensifying rivalry between the world’s two superpowers, and Europe’s mounting competitiveness challenges amid ongoing industrial decline.

“Between the unstoppable rise of US LNG, the political posturing around rare earth elements, the devastating uncertainty in the UK North Sea, the clear-out in European petrochemicals, and the AI-driven power demand surge, these trends track the wonders and the warnings of the energy and resource transition in 2025 and beyond,” said Malcolm Forbes-Cable, Vice President, Upstream and Carbon Management Consulting at Wood Mackenzie.

U.S. LNG: the turnaround of all turnarounds. The US has emerged as the world’s hydrocarbon superpower, exemplified by its meteoric rise in the Liquefied Natural Gas (LNG) market.

- By 2030, the US is projected to account for 30% of global LNG output.

- You don’t need to look too far back to find a US which was building LNG import infrastructure and now in under 10 years it has become the world’s largest LNG exporter.

- The US also leads global oil production (including oil, condensate, and natural gas liquids), delivering one-fifth of the world’s volumes. In comparison, its closest competitors, Saudi Arabia and Russia, produce only 65% and 50% of US volumes, respectively.

“The resurrection of US LNG is a crucial reminder of what a resource-rich, free-market country like the US can do. This hydrocarbon hegemony is now being leveraged as a diplomatic tool,” Forbes-Cable remarked.

Rare earth elements – a high note in global trade.

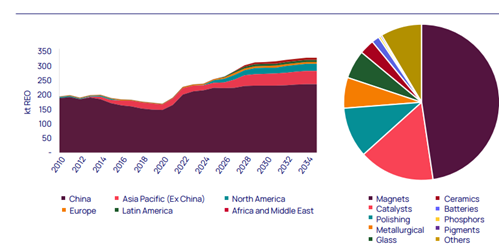

FIG. 1. Rare earth elements refined supply outlook (left) and rare earth applications (right).

Rare earth elements have moved to the center of global trade negotiations, becoming a focal point of the growing interplay between materials science and high-tech industrial strategy. Their role spans critical applications, including renewable energy technologies, advanced weapon systems, electronics, and semiconductors, positioning them at the heart of geopolitical competition. Magnets alone account for almost half of all rare earth elements use.

- China currently commands an extraordinary strategic advantage, accounting for almost 90% of the world’s refined rare-earth supply.

- This leverage is particularly striking given that the US was the world’s leading producer until the late 20th century.

National value destruction in the UK North Sea. The UK oil and gas sector has become an egregious outlier among OECD countries due to persistent fiscal and regulatory uncertainty, leading to significant value destruction.

- The Implied Long-Term Oil Price (ILTOP) for transacted UK North Sea assets is charting around US$40 per barrel, a whopping 40% discount compared to the OECD average of roughly US$70 per barrel.

- This discount reflects the upstream industry’s declining interest, spurred by five major changes to the fiscal system in two and a half years mixed with regulatory uncertainty.

“The scale of the discount reflects the reality of how seriously investors view the UK’s fiscal and regulatory instability. Frequent shifts to the fiscal regime and ongoing regulatory uncertainty have weakened confidence and held back capital. The chart makes clear the value destruction in the UK’s upstream sector,” Forbes-Cable added.

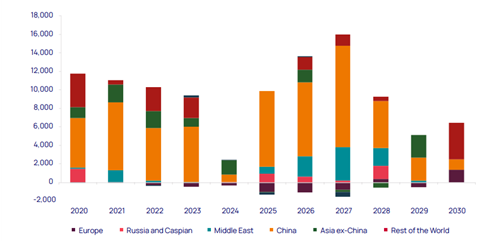

Petrochemical clear-out: Europe’s declining capacity in a hot growth sector.

Europe is driving down emissions, but a less positive side effect is de-industrialization, as industrial activity is transferred to other regions.

- Global ethylene manufacturing capacity shows a pattern of closures in Europe contrasting sharply with significant growth elsewhere, especially in China.

- The plant closures between 2022 and 2027 represent an annual loss of about US$4 billion in gross value added to the European economy.

- This all comes with significant human cost. The announcement of the closure of ExxonMobil’s Fife Ethylene Plant in Scotland, Europe’s fourth largest by capacity, will lead to 400+ job losses.

Power up: the engine of AI growth .

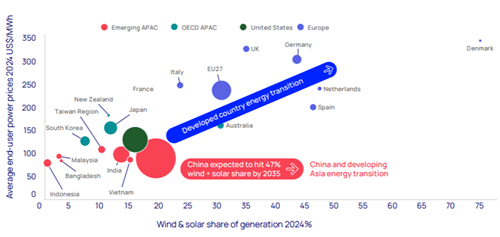

FIG. 3. End-user power prices vs the wind and solar share of generation, by country. Note: Bubble size represents size of the power market in 2024.

The Artificial Intelligence (AI) megatrend is driving growth in global power demand. The US power market, a low-growth zone for decades, is forecast to see its AI-driven power demand grow at a massive compound rate of 20% to 2030. There is a growing call on gas-fired power, but with rising gas prices and the rapid inflation of build costs for new power plants power prices are expected to rise.

- Data center operating costs are typically about half power-related, making electricity prices a crucial factor in the global AI race.

- Europe's economic disadvantage due to high power prices is apparent in a chart mapping national power prices against wind/solar generation share. China, conversely, has very competitive power prices and with 47% of its power generation forecast to come from wind and solar by 2035, combined with its dominance of the renewable's technology supply chain, power prices are expected to remain low.

Related News

Related News

- Freeport LNG export plant in Texas to take in more natgas after unit shut on Monday

- Aramco's Jafurah gas plant (Phase 1) begins output

- U.S. natural gas prices surge 4% to 35-month high in cold snap

- LNG cool-down vessel arrives at ExxonMobil's Golden Pass plant in Texas

- Freeport LNG export plant in Texas reports shutdown of liquefaction train

Comments