EIA: Coal may surpass natural gas as most common electricity generation fuel this winter

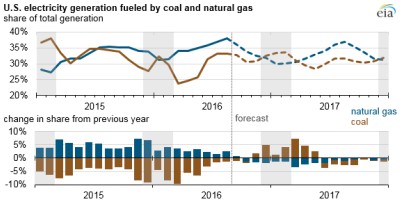

After declining for several months, the share of U.S. electricity fueled by coal is expected to slowly begin growing when compared to the same period last year. In contrast, the share of generation from natural gas is expected to experience year-over-year declines. Based on expected temperatures and market conditions, coal is expected to surpass natural gas as the most common electricity generating fuel in December, January and February.

|

| Graph Courtesy of EIA. |

Natural gas had long been the second-most prevalent fuel for electricity generation behind coal, but it became the power industry’s primary fuel source for the first time in April 2015. Natural gas-fired generation has surpassed coal-fired generation in most months since then, and generation fueled by natural gas reached record levels this past summer. During the first six months of 2016, natural gas supplied 36% of total U.S. electricity generation compared with 31% for coal.

During periods where available generation capacity exceeds electricity load, selection of which capacity to run often reflects relative operating costs, which largely reflect generators' fueling cost. When measured in terms of the cost of fuel it takes to generate a megawatthour (MWh) of electricity, to account for the different efficiencies of power plants, the prices for natural gas and coal were relatively competitive for much of 2015. At the beginning of 2016, the national average price of natural gas was consistently below the cost of coal delivered to power plants, reaching a low point of about $16/MWh in March, while coal has averaged between $21/MWh and $23/MWh for the past two years. Natural gas prices were low earlier this year because of ample fuel supplies and mild winter weather, which also reduced overall electricity demand.

Spot prices for natural gas have generally been rising in recent weeks. The cost of natural gas delivered to electric generators, which includes both spot market and contract purchases, has been increasing as well. The latest available data indicate that the generation cost of natural gas averaged $21.30/MWh in August, which was nearly identical to the cost of coal.

- Freeport LNG export plant in Texas reports shutdown of liquefaction train

- TotalEnergies and Mozambique announce the full restart of the $20-B Mozambique LNG project

- RWE strengthens partnerships with ADNOC and Masdar to enhance energy security in Germany and Europe

- Five energy market trends to track in 2026, the year of the glut

- Venture Global wins LNG arbitration case brought by Spain's Repsol

Comments