Smaller-scale and modular technologies drive GTL industry forward

Lee Nichols, Editor/Associate Publisher, Hydrocarbon Processing

Between 2013 and 2015, numerous GTL facility projects were announced, primarily in the US. GTL technology was made attractive to investors by the onset of cheap natural gas prices (spurred by US shale gas exploration) vs. a spike in crude oil prices. At the time, only a few commercial-scale facilities were operational around the world, and the possibility of producing greater volumes of ultra-clean transportation fuels from cheap, environmentally friendly feedstock created this surge in new GTL project announcements.

However, as crude oil prices have fallen dramatically over the past 2 yr, many GTL projects have lost their price advantage. Commercial-scale projects are no longer economical to pursue. This trend has led to the cancellation or indefinite delay of a number of GTL projects.

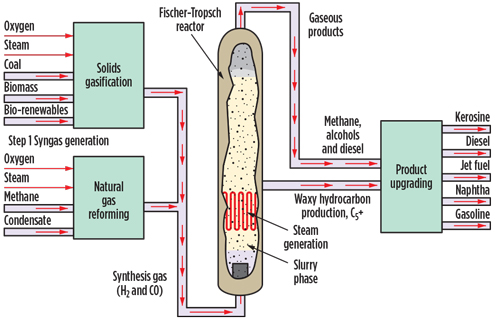

Most existing GTL facilities and projects in development incorporate the Fischer-Tropsch (FT) process (FIG. 1), which involves synthesis gas regeneration, FT conversion and liquid hydrocarbon upgrading. As commercial-scale plants are no longer economical, the GTL market is pushing toward small-scale and modular units. These types of plants can be built at greatly reduced capital cost, which can run into the billions of dollars for large-scale facilities.

|

FIG. 1. The GTL process. Source: Sasol Chevron. |

|

The following overview of the GTL market includes commercial-scale facilities in operation, abandoned plants and the move toward smaller-scale processing facilities.

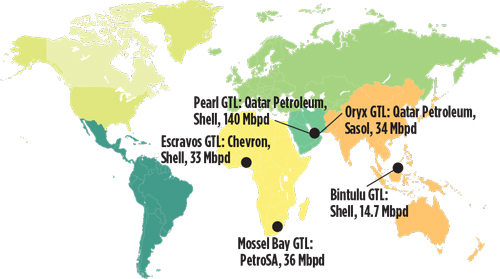

Commercial-scale GTL plants. At present, five commercial-scale GTL plants are in operation (FIG. 2). These five plants include:

- Bintulu GTL, Malaysia

- Escravos GTL, Nigeria

- Mossel Bay GTL, South Africa

- Oryx GTL, Qatar

- Pearl GTL, Qatar.

These five plants represent nearly 259 Mbpd of capacity. At 140 Mbpd, Shell’s Pearl GTL complex represents 55% of the world’s total commercial-scale GTL capacity.

|

FIG. 2. Commercial-scale GTL plants in operation around the world. |

|

The first GTL plant was developed by PetroSA in 1992. The 36-Mbpd plant is in Mossel Bay, South Africa, and remains the second-largest GTL plant in operation after the Pearl GTL complex. According to PetroSA, the plant receives its feedstock from the company’s FA-EM and South Coast gas fields, as well as the Oribi and Oryx oil fields in Block 9, offshore South Africa.

The plant utilizes FT technology to process methane-rich natural gas into high-quality, low-sulfur synthetic fuels. Products include unleaded petrol, kerosine, diesel, propane, distillates, process oil and alcohols.

Shell commissioned its first commercial GTL plant in Bintulu, Malaysia in 1993. The plant’s initial construction cost was $850 MM. The 12.5-Mbpd plant underwent a $50-MM debottlenecking that increased total capacity to 14.7 Mbpd. In total, Shell has invested more than $1.3 B in the Bintulu plant.

The Pearl GTL complex is the largest GTL facility in the world (FIG. 3). The 140-Mbpd facility is located in Ras Laffan Industrial City, Qatar. The $19-B natural gas processing and GTL integrated complex was developed by a JV of Shell and Qatar Petroleum. The plant was built in two phases. Phase 1 of the plant included the construction of Train 1, which was put into operation in late 2010. In Phase 2, an additional train was added to the facility and put into operation in 4Q 2011. Full ramp-up of the plant came in early 2013, a decade after the start of Shell’s first GTL facility.

|

FIG. 3. Shell’s Pearl GTL facility in Ras Laffan, Qatar is the world’s largest GTL facility. Photo courtesy of Shell. |

|

Pearl GTL can process approximately 1.6 Bcfd of wellhead gas from Qatar’s North Field. Natural gas extracted from the North Field is first processed in the facility’s gas processing section. Contaminants, as well as NGL, are removed from the sour natural gas. The extracted ethane is used for petrochemical production, the LPG for domestic heating fuel, and the condensates as feedstock for refineries. The processed natural gas is then piped to the GTL portion of the facility for additional processing.

Oryx GTL was the Middle East’s first GTL plant. Developed by Qatar Petroleum and Sasol, the $6-B plant also processes natural gas from Qatar’s North Field. Construction of the facility began in late 2003, and it started production in early 2007. The facility processes 330 Mcfd of methane-rich gas from Qatar’s North field and produces 34 Mbpd of liquids, with the majority being low-sulfur, high-octane GTL diesel.

The latest commercial-scale GTL plant to commence operations is the Escravos GTL plant. The $10-B facility was developed by a JV consisting of Chevron, Sasol and Nigerian National Petroleum Corp. Located in the Niger Delta, Nigeria, the plant is approximately 60 mi southeast of Lagos. Escravos GTL was designed to reduce natural gas flaring in Nigeria. The plant utilizes technology from both JV partners to convert up to 325 MMcfd of natural gas into 33 Mbpd of GTL diesel and GTL naphtha. The initial cost of the project was roughly $2 B, but due to construction delays, the total capital cost surged to $10 B. The plant has been operational since 2014.

New GTL facilities under development. Due to the high cost of building a commercial-scale GTL plant, only three additional plants are in development. These three plants are located in the Commonwealth of Independent States (CIS): two GTL plants are being developed in Turkmenistan, with another in Uzbekistan.

In mid-2016, Turkmenistan’s state-owned natural gas company, Turkmengaz, broke ground on its second GTL plant. The facility is located at Ovadan-Depe, near the country’s capital city of Ashgabat. The country’s first GTL facility, also located in Ovadan-Depe, will ramp up to full operation in 2018.

Turkmenistan has a vast amount of natural gas reserves, but production is lacking. However, the government has instituted programs to boost oil and gas production to monetize the country’s abundant resources, as well as to diversify its economy away from a heavy reliance on natural gas. This program includes the construction of the $7-B Kiyanly petrochemical complex, which will receive feed gas from operations in the Caspian Sea. Natural gas from the country’s domestic reserves will also feed the $1.3-B Garabogaz fertilizer project and both GTL plants in Ovadan-Depe.

Turkmengaz’s first GTL plant will process approximately 1.8 Bcmy of natural gas to produce 600 Mtpy of Euro 5 gasoline. The company’s second GTL plant will be able to process approximately 2 Bcmy of natural gas into 600 Mtpy of GTL gasoline. In April 2015, Turkmengaz awarded an engineering, procurement and construction (EPC) contract to a consortium comprised of South Korea’s Hyundai Engineering and LG International to build the facility. The $2.5-B plant is expected to begin operations in 2019 or 2020.

The third commercial-scale GTL plant is being developed in Uzbekistan. The $6-B Oltin Yo’l GTL project is being developed by Uzbekistan’s state-owned natural gas company, Uzbekneftegaz, along with project partner Sasol. As in Turkmenistan, the government in Uzbekistan has a vast amount of natural gas resources that it is trying to monetize. These plans include the construction of the $4-B Surgil Natural Gas Chemicals project (completed in late 2015), the development of the Navoiy ammonia-urea plant, the $2.7-B Kandym gas processing plant (which will process sour natural gas from the Kandym group of fields located in the Bukhara region), and the Oltin Y’ol GTL facility. In total, Uzbekistan is investing more than $15 B to boost downstream production capacity.

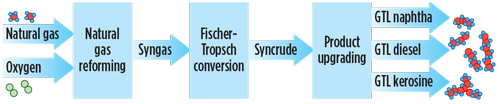

In English, Oltin Yo’l translates to “Golden Road” and is a reference to the centuries-old trade routes that passed through Uzbekistan—more specifically, Samarkand, the country’s second city. Uzbekistan’s government also believes that this project, along with other downstream projects, will set the country on a golden road to developing a clean and sustainable energy future. The plant will be located at the Shurtan gas and chemical complex in the Kashkadarya region of southern Uzbekistan. Oltin Yo’l will utilize Sasol’s Slurry Phase Distillate Process to produce GTL diesel, GTL kerosine and GTL naphtha. The three-stage process is shown in FIG. 4.

|

FIG. 4. Sasol’s three-stage Slurry Phase Distillate process will be used in the Oltin Yo’l GTL facility. Source: Sasol. |

|

Small-scale is the future. Due to the large capital cost of building a commercial-scale GTL plant, nearly all additional large-scale GTL projects have been abandoned. For example, Shell canceled its $12-B Louisiana GTL project in late 2013. The 140-Mbpd plant, which was to be located in Ascension Parish, would have been the first commercial-scale GTL plant built in the US. However, the uncertainty of crude oil and natural gas prices, along with the proposed project’s high capital cost, caused the company to shelve the project.

Sasol also decided to cancel its proposed, $14-B plant in Lake Charles, Louisiana. The 96-Mbpd plant was expected to produce high-quality, clean-burning transportation fuels, as well as GTL naphtha, LPG, GTL base oils, wax, paraffins and linear alkyl benzene. However, the mega-scale facility was abandoned in early 2015 due to the drop in oil prices, which made the project uneconomical. Sasol is still developing its $11-B ethane cracker and derivatives complex, which is also located in Lake Charles. After completion in 2019, the petrochemical complex will roughly triple Sasol’s chemical production capacity in the US.

These large-scale plants were designed during a period of record-high oil prices. As the price of crude oil decreased, commercial-scale projects were not viable. Consequently, GTL technology has moved toward smaller economies of scale and modular units. This trend allows small units to process natural gas in remote areas, such as in the Bakken region of North Dakota. Small-scale GTL units can provide an outlet for stranded gas that likely would have been flared, as well as produce liquid fuels from natural gas that would otherwise be too expensive to process.

New regulations are discouraging gas flaring in shale plays. Emissions policies provide a strong financial nudge to producers to implement gas gathering systems to collect gas from the well site and transport it to gas processing plants. However, in cases where no gas processing plant is located nearby, small-scale processing plants can be assembled onsite, from prefabricated modules, to collect the gas and process it into saleable products, such as LNG or GTL fuels.

Processing capacity can be easily increased by installing additional modular units, and the fuels produced can be used in local transportation networks. The gas can also be used as fuel for onsite power generation at shale oil and gas operations.

Numerous small-scale GTL facilities, pilot and demonstration plants have been announced or built in the US. Some of these projects convert natural gas into fuels, or convert natural gas into methanol and then into fuels, while others will process biomass into liquid fuels. Companies such as G2X, CompactGTL, Siluria, Primus Green Emergy, INFRA Technology, Juniper GTL, Velocys and ENVIA Energy will be instrumental in advancing small-scale GTL technologies in the future. Only a handful of plants are operational, but research and development continues to make GTL technology an economical solution for the production of high-quality, clean transportation fuels.

As crude oil prices have substantially fallen over the past two years, so has the commercial-scale development of GTL facilities. The sheer economics of GTL processing have moved the industry toward small-scale and modular designs. The smaller economies of scale make GTL conversion more economical, especially in remote spots around the world where the extracted natural gas would have been flared. Instead, new GTL technologies will allow operators to process it into high-quality fuels. GP

Comments