Overcome engineering challenges for multi-well gathering facilities

T. Farley and T. Hutchinson,

Halker Consulting, Lone Tree, Colorado

The North American energy sector has recently experienced growth at an unprecedented pace. Directional drilling and hydraulic fracturing have revitalized the petroleum landscape by facilitating access to new formations and new products from existing formations, all with the advantages of allowing more centralized, consolidated well and surface operations.

While the industry revenues, rig counts, and barrels-per-day numbers paint a picture of unchallenged prosperity, this large, rapid increase in production is not without ramifications—both visible and hidden.

Infrastructure challenges abound. The existing US infrastructure is made for refining and consuming, rather than for transporting and exporting. To truly take advantage of this windfall (and assuming the political parameters of export will change), the country will need to retool refineries for the processing of shale-derived NGLs and light sweet crude oil, as well as build the conveyance and port systems to efficiently sell US bounty to other countries.

From pipelines, to rail, to central processing, there is a long way to go to truly capitalize on the opportunities offered by shale gas and oil. Beneath this large, highly visible challenge, a more complicated, foundational issue is found in the capacity to safely, rapidly and efficiently gather and manage increased production volumes from new drilling strategies with an antiquated infrastructure of surface facilities.

Leading the US energy renaissance is the adoption of directional drilling and multi-well pads. These trends have resulted in vastly increased production volumes into sites that may still have the real estate footprint of a single, vertical well. This increased volume dwarfs historical upstream production and, subsequently, can easily overpower the existing approach to installing field gathering, processing and storage facilities. For numerous reasons, the history and culture of building onshore surface facilities is lacking in sound, standards-driven engineering.

So is anyone doing it right? Fortunately, there is a viable operations model already in existence. A best practice in managing large volumes of product at a centralized point, with high levels of reliability, has been in continuous operation for decades: offshore petroleum production. For years now, offshore oil drilling platforms have been managing multiple directionally drilled wells producing significant quantities of product into a centralized operation with a small footprint.

While these high-volume, high-reliability, low-tolerance environments are not without risk, the overall safety of offshore processing can be seen trending in a positive direction, according to January 2014 data from the BSEE Database. The key factor in the success of these highly reliable, high-risk environments is well-executed engineering and design. Today, there is increasing adoption of the offshore gathering model for onshore directional drilling projects.

Success in single, vertical wells was more feasible without robust gathering and processing equipment because the production volumes were lower. The exponential increase of product gathered and handled at a single site means that today’s multi-well site operators must recognize the increased levels of risk that come with more production.

If onshore production is experiencing similar production increases to a consolidated offshore model, inherently, most safety risks are similar. Furthermore, if higher production increases risk, should not onshore facilities receive similar accountability to engineered standards, safety systems and efficiency? What are the challenges associated with bringing the engineering mindset of offshore to onshore?

Breaking down the challenges. As the industry continues to improve on its approach to developing unconventional fields, there are several key areas in which engineering and design companies have seen operators struggling, as discussed below.

Safety. At the core of new drilling techniques is a simple equation: greater volume equals greater risk. As directional wells delivering high volumes to a single point becomes the norm, there is a significant increase in demand for surface infrastructure to safely handle the load. Consider the offshore environment: Should a person feel comfortable working on an offshore platform that had not been engineered to safely support massive increases in volumes and pressure? Onshore operators trying to force-fit new wells or retrofit old wells with antiquated and non-standardized equipment, may find themselves in a similar scenario.

If an operator is in the transition from vertical to horizontal drilling, and/or from drilling liquid to dry wells, the following question should be asked: “If an incident were to occur on any one of these facilities, would documentation be present to back up what equipment is on that location and why?” Also, “does the company take certain precautions to help ensure that, when that facility was constructed and turned on, an incident would not occur?” These are the types of questions that sound engineering disciplines can help answer, while also helping mitigate the risk of antiquated equipment used for increased production.

Exponential increase in product. A primary output of multiple directional wells is the significant increase in the volume of production at a single point. Horizontal drilling technology alone can account for a single well producing nearly 10 times as much as a vertical well in the same area. To compound that scenario, horizontal wells can be clustered to take advantage of consolidated and centralized equipment, smaller pad real estate, and well site placement that is more convenient to both landowners and operators. However, well sites can fast approach a 100-time increase in volume as multiple, high-volume wells come online.

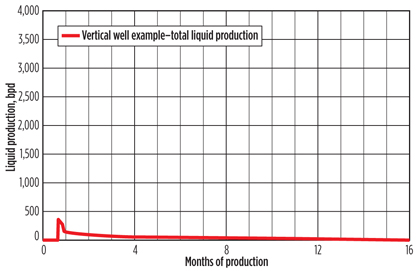

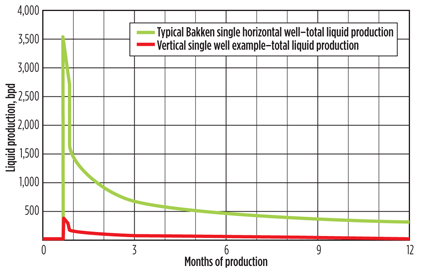

Fig. 1 shows a typical curve of total liquid production from a single vertical well in the Bakken shale. Peak production reaches about 400 barrels per day (bpd), with the major decline occurring within just a few days of initial turn on. When the curve for the vertical well is compared to the curve for a horizontal well in the Bakken (Fig. 2), the rate typically increases from approximately 400 bpd to over 3,500 bpd.

|

|

Fig. 1. Typical curve of total liquid production from a single vertical Bakken well. |

|

|

Fig. 2. Typical curve of total liquid production from a single horizontal Bakken well. |

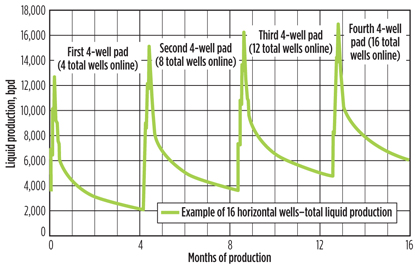

In the case of multi-well pads, peak rates for multiple wells on a single production pad are multiplied many times, as shown in Fig. 3. Commonly, multi-well pads are turned into a single processing point. With such a significant increase in production, the risk associated with the equipment is daunting and will likely be a driving force in the evolution of the onshore industry.

|

|

Fig. 3. Peak rates for multiple wells on a single production pad. |

Antiquated equipment. Single, vertical well production rates typically are not overwhelming, and tend to result in equipment sizing through “guessing and checking.” While this approach is inefficient, lacking in standards, and not technically condoned, at these smaller rates, it still allows the product to be managed. Many systems have been pieced together like jigsaw puzzles simply because it has “always been done this way.” This approach hinders the ability for continuous performance and process improvement.

These antiquated facilities are challenging today’s operators with increased volumes that cannot be managed with the same layouts for vertical wells. The onshore oil and gas sector is facing an interesting phenomenon—the biggest, best, most rapidly evolving production boom ever experienced is, in many cases, being processed in unsafe, undersized, underwhelming facilities.

Vertical facilities are lacking in a number of ways. Most importantly, safety systems are frequently undersized or inadequate and do not properly protect the process from upset conditions, when compared to American Petroleum Institute standards. Underrated and undersized pipe is a carryover from smaller facilities, and it introduces areas where leaks or ruptures can occur, putting undesirable stress on a well from built-up backpressure.

Many facilities have nowhere to sell gas or do not benefit from secondary gas capture, which would increase profits and reduce emissions. As illustrated in the next section, this lack of standards presents far too many opportunities for system error due to a lack of proven engineering, standardized system designs and volume-based site specifications.

Underdeveloped infrastructure. In many fields, the primary challenge can be underdeveloped infrastructure. As the transition is made from vertical wells to horizontal, the existing piping infrastructure becomes insufficient. Multiplying site production by 5, 10 or even 15 horizontal wells can result in a possible peak rate of over 16,000 bpd repeated across entire fields. Is existing infrastructure designed to handle this? Some plays have no piping infrastructure at all. For the vast majority of fields, if the infrastructure is there, it is still undersized. Other questions to be asked with regard to infrastructure include:

- If there are pipelines in place, where does the product go?

- Are downstream facilities properly sized?

- How often do facilities experience a shut-in because of an overload in downstream gathering?

- Does a given site rely on gas sales for economics?

- Can a producer move gas off of its facilities, or must it be flared?

- If the gas is being flared, is the producer about to reach the emissions cap for its facility?

These questions are all real-world considerations as new oil and gas plays become viable and the industry continues to grow at breakneck speed.

Lack of documentation and standards. It is increasingly clear that a standardized approach to field development is greatly needed in present directional drilling. Intracompany standards—those specific to a single company—can often be nonexistent. Not having documentation to support existing equipment is even more problematic today, as workers are changing roles and companies more frequently.

If a company’s production foreman or construction foreman moves on, what documentation and information are left to communicate process conditions and lessons learned to the next person in that role? Process flow diagrams, piping and instrumentation diagrams and cause-and-effect documentation are the blueprints and instruction manuals for facilities that can be standardized and repeated across entire fields. Ideally, the new production foreman should be given a packet that familiarizes him or her with any pad he or she walks onto, illustrating control valve types and set pressures, equipment ratings, allowable pressure ratings for pipes and so on. The ability to do so also greatly facilitates field growth and scaling because system knowledge is being reapplied, not continually recreated.

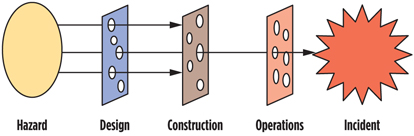

Every process or design has inherent layers of protection if industry best practices and safety standards are utilized properly. For multi-well facilities, defensive barriers are created through engineering, construction and operations. Even in cases when the best industry practices and standards are used, certain holes may exist in a design due to human error or manufacturing flaws. Potential hazards are mitigated daily by the defensive barriers.

Unfortunately, if enough holes in the barriers exist and align at just the right moment, then a hazard can lead to a major incident (Fig. 4). Operators should ask, “What specific standards does our company follow, and are those standards adequate to protect people and the environment?” Experienced operators realize that, with increased production comes increased risk, and major efforts should be taken to ensure that employees, communities and the environment are protected.

|

|

Fig. 4. If enough holes exist in hazard barriers, then a major incident can occur. |

Minimal operating experience. Looking at the larger picture, the operation of onshore multi-well facilities is still in its infancy. Out of necessity, offshore platforms utilize bulk/test separation methods to limit equipment and keep the footprint small. Due to allocation issues stemming from multiple-well owners on a single pad, onshore operators are still struggling with laws and regulations to accept and standardize the bulk/test separation method.

Understanding how allocation works, how well testing works and what the laws are, versus what would be “nice to have” or “what is actually needed to produce effectively,” helps companies realize additional land and cost savings.

For example, a facility setup for a multi-well facility is pictured in Fig. 5. This facility features 12 wells, with each well equipped with two stages of separation. In total, there are 63 permanent pieces of major process equipment on this location.

|

|

Fig. 5. Facility setup for a multi-well facility. |

Understanding allocation and commingling rules results in the ability to move to bulk/test separation, similar to what is found offshore. The location in Fig. 6 has 14 more wells, but eight fewer permanent pieces of equipment than the facility in Fig. 5. The operator in Fig. 6 experienced additional savings in footprint and equipment costs.

|

|

Fig. 6. Facility setup for a multi-well facility with more wells and |

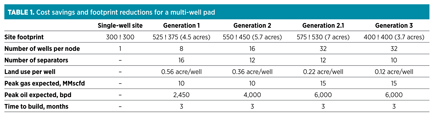

The data in Table 1 are taken from a case study that demonstrates cost savings and footprint reduction through multiple generations of facility design for the same operator. The Generation 1 column shows land and equipment usage with individual separation trains for eight wells. The Generation 2 column illustrates the shift from individual separation trains to bulk/test separation for 16 wells. The land use was reduced from one-half acre per well to one-third acre.

Generation 2.1 added 16 more wells from Generation 2, with facility optimization allowing for new wells to be strategically placed in high-pressure or low-pressure equipment, depending on well performance, without the need to add equipment. The land usage was reduced from one-third acre per well to one-quarter acre.

Finally, Generation 3 utilized a gathering system and processed liquid and gas at a central processing facility, eliminating the need for onsite storage and further reducing land usage from one-quarter acre per well to one-tenth acre.

Minimal capital investment in wellheads. Companies may struggle to make upfront capital investment in engineering and design, even if the extra initial cost is paid for and if benefits are realized in smart, efficient, safe and environmentally conscious designs. Proper engineering enhances production over the long term. The idea is that good, lean engineering pays, but does not cost.

Culture. As the offshore production model moves onshore, the industry’s biggest challenge is the culture. For decades, the gathering and processing of smaller vertical wells was sufficiently met by one-off, non-standardized facilities. With today’s consolidated multi-well sites producing exponential volumes and needing to attend to evolving regulations and public scrutiny, operators may struggle with how to validate the cost of properly engineering systems. Furthermore, there is an overall sense of urgency to capitalize on the rapid growth and success of the market.

Meeting the challenge. There is a significant upside to meeting the challenges of this industry in transition. As the US experiences a revolution in petroleum production, petroleum export-to-import ratios could reverse for the first time in the nation’s history. To take advantage of this evolving market, there are several engineering-specific aspects to consider.

Optimize wells and field development. By centralizing, consolidating and optimizing surface facilities, owners and operators can maximize asset value through economies of scale and better management of equipment costs. This benefit comes from the ability to manage costs and efforts based on type-curve production flows for all wells in a given field.

As discussed earlier, offshore operations have long benefited from central processing facilities. Upstream facilities are also seeing the value of centralizing processing assets at the well site due to the increased production coming from multi-well configurations.

Centralizing operations puts the physical point of well management and maintenance in one place. This scenario significantly reduces the time and travel needed to monitor and maintain multiple, distributed sites—a decrease in operational expenditure. Additionally, centralization supports less land usage and more flexibility in the choice of deployment of a facility site. Instead of having multiple, dispersed facilities covering a large portion of land, a single, multi-well facility can be placed in an optimal location that serves both the daily work of landowners and facility production operations.

A key strategy enabled by centralizing is the consolidation of assets. Consolidation allows the elimination of redundant equipment and the consideration of larger and/or more scalable solutions, all of which positively impact a project’s capital expenditure.

A traditional, single-well development plan having 12 vertical wells on 12 separate sites would require 12 storage tank solutions. Additionally, the point source emissions would require the necessary equipment to properly flare or collect secondary gas products before handing off to midstream operations—at all 12 sites. With 12 wells delivering product centrally, large efficiencies can be made in determining what types of processing and storage can be used. Additionally, the secondary products collected can be processed at a single location, lending to secondary capture and sales from increased volumes.

By taking advantage of the maturation of well flows and pressures, facilities can be designed with modularity and scalability, allowing operators to better manage the growth and transformation of their entire field asset.

Proven, prefabricated processing equipment can be brought online, maintained and then removed and redeployed as the production needs follow the well’s production curve. This strategy allows for redeployment of hard asset purchases according to well site flows, and it utilizes them on newer facilities, reducing the overall cost of equipment.

By staggering the drilling of wells, well facilities do not need to be permanently built for only the highest production flows. This allows for entire fields to be developed using more cost-effective infrastructure designs. If staggering is difficult, then the use of modular equipment to handle peak production is a secondary strategy that can be used to manage cost.

Recent advances in type-curve analysis and understanding of future drill plans allow engineers to design for anticipated production numbers. They also allow operators to refine drill schedules to accommodate piping infrastructure already in place.

Flaring and environmental impact. By leveraging consolidation and centralization strategies, owners and operators can save costs on the equipment needed to manage point source emissions, as there are fewer facilities, resulting in fewer emissions point sources to engineer and manage.

In some cases, rather than flaring small amounts of secondary gases, newer technologies and facility designs allow for such gases to be collected at a single point, making the business case for marketing these secondary products for additional revenue.

In addition to better emissions management, the consolidation of wells to a single site can decrease land impact by up to 80%, depending on the field development plan used. Less land use allows for operators to more readily acquire permits in highly regulated development areas.

Case study: Handling volume in the field. Centralized well pads with bulk/test separation into commingled tank batteries require smaller footprints for well pad facilities than ever before. What is the next step? How are facilities made even smaller? How can the tank battery be discarded completely? For operators with significant field development opportunities, central processing facilities provide additional savings in land use, equipment cost and trucking.

Properly sized gathering systems from multi-well pads collect fluids directly from the well head separators and transport them to a large processing facility. The facility shown in Fig. 7 is designed to process 58,000 bpd of liquids and 120 million standard cubic feet of gas. The facility has a modular concept to allow for construction and production dates to be met early on in field development, while still accommodating expansion plans later in the development phase. Facilities such as this one further reduce the amount of required permanent equipment on well pads and collect all product at a single point, truly mimicking offshore production.

|

|

Fig. 7. Multi-well pad facility with a modular concept. |

Takeaway. The US energy paradigm is undergoing a massive transformation. In addition to the evolution of renewable energy technologies and the changes being driven by climate issues, the gas and oil opportunities evolving within the US and around the world are at an all-time high.

At the heart of these opportunities are horizontal drilling techniques and multi-well production facilities. These offshore-born approaches to onshore production are proving to be true game-changers.

Field development projects using horizontal drilling are increasing the production of new deposits and allowing existing formations to be reconsidered. Also, by adopting a multi-well approach, costs and environmental impacts can decrease as production rises.

One fact not to be overlooked is that this increase in production goes hand-in-hand with increased risk and responsibility. Multi-well production facilities are larger in scope and, consequently, they require a higher degree of professional engineering to ensure safe, scalable and cost-effective facility design. Without this key component, operators may face significant challenges in implementing new technologies safely and in line with evolving regulations and compliance requirements.

To truly capitalize on this significant shift in the industry, producers will need to utilize highly skilled facility engineering and design. This can be challenging since engineering and design are rarely in-house, core competencies of production companies. Moreover, as aging personnel exit the workforce, a significant amount of knowledge may leave with them if it is not skillfully transferred to the smaller firms and younger engineers entering the industry.

The engineering and design process exists to identify problems, to provide solutions to those problems, to find the solution that best suits an operator’s goals and needs, and to work out bugs and improve on designs. How many hours are being wasted and how many dollars have been spent dealing with problems that could have been addressed before a site was even built? Sound engineering helps safely manage the tremendous amount of change that is driving the growth of the US energy industry, and it also helps maximize opportunities along the way. GP

|

Tyler Farley is a project engineer at Halker Consulting. She entered the oil and gas field as a hydraulic fracturing engineer for BJ Services. At Halker Consulting, Ms. Farley has focused on upstream facilities and infrastructure development for onshore production facilities in unconventional plays, primarily the Niobrara and Bakken shales. Ms. Farley has managed the engineering and design of safe, fit-for-purpose facilities that utilize standard engineering practices in areas where these practices are not commonly used. She holds a BS degree in chemical engineering from the Colorado School of Mines.

|

Travis Hutchinson is the business operations manager and process department manager at Halker Consulting. His expertise is focused on helping clients manage the industry shift toward onshore integrated development plans, particularly those leveraging consolidated production pads and centralized processing. Mr. Hutchinson directs multi-disciplinary teams in engineering upstream onshore production facilities with a fit-for-purpose approach that is rooted in existing safety and design standards. Prior to joining Halker Consulting, he worked as a project engineer for REH, developing a coal-to-nitrogen-based fertilizer plant. Mr. Hutchinson graduated from the Colorado School of Mines with a BS degree in chemical engineering.

Comments