Regional perspective: US NGL

S. McGinn, Contributing Editor

The US petroleum market has undergone a significant expansion due to the advent of shale gas, and its effects are leading a booming resurgence in the NGL market. Shale gas has spurred a buildout in the domestic NGL market, from key fractionation and storage hubs to petrochemical plants and export terminals.

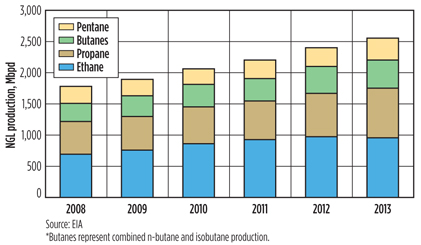

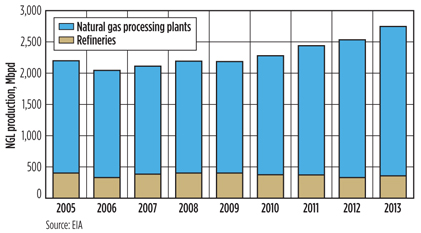

The primary sources of raw, or Y-grade, NGL in the US are natural gas processing plants and crude oil refineries. Gas processing plants produce raw NGL as a mixed stream that must be further processed, or fractionated, to achieve a purity form (Fig. 1). Refineries make LPG (i.e., propane and butane) as a byproduct of oil refining (Fig. 2).

|

|

Fig. 1. Production of NGL from US gas processing plants, 2008–2013. |

|

|

Fig. 2. Production of NGL from US gas processing plants and crude oil refineries, |

Once broken into their suitable components via fractionation, NGL are widely useful products. Purity ethane, which is a product marketed as 95% ethane, is the primary building block for ethylene. It can be lumped in with the natural gas stream, but in limited quantities.

Propane is a transportation fuel, a heating and drying agent, and a chemical feedstock. Butanes are used for fuel, for gasoline blending and for petrochemical feedstocks. Natural gasoline, or pentane, can be used as a motor gasoline component, as a petrochemical building block, or to dilute heavy crude oil streams that cannot be transported without blending.

At the heart of the NGL production and purification process is the fractionator, which processes Y-grade into separate components: ethane, propane, normal butane (n-butane), isobutane and pentane.

As the transition from dry gas to liquids-rich drilling unlocked an increasing number of liquids, NGL volumes grew at an average of 7%/yr between 2008 and 2013. Those increases were concentrated primarily on the US Gulf Coast (USGC), according to the US Energy Information Administration (EIA). In response to that growth, the NGL infrastructure in the USGC is undergoing a massive expansion.

Mont Belvieu market

Mont Belvieu, Texas is the epicenter of the US NGL market. Located 30 mi east of Houston in Chambers County, Mont Belvieu is situated in the USGC petrochemical and refining region, and its close proximity to the Houston Ship Channel makes US-produced NGL a budding international business.

With growing supplies of NGL stemming from liquids-rich shale gas, the Mont Belvieu boom is witnessing the addition, expansion and even reversal of pipelines; the construction and enlargement of fractionation units; the addition and expansion of LPG marine terminals; and groundbreaking activities on new steam crackers.

Enterprise Products Partners. The midstream giant operates eight fractionation units with a total processing capacity of 670 Mbpd. Fractionators 7 and 8 went into service near the end of 2013. Within the last five years, the company has tripled its NGL processing capacity to 670 Mbpd, and it has already started a permitting process to erect two more fractionators in Mont Belvieu.

ONEOK Partners. Tulsa, Oklahoma-based ONEOK Partners operates two fractionators in Mont Belvieu, with one more on the way. Its first fractionator underwent an expansion to double capacity to 200 Mbpd, and the newly built MB-2 tower is presently operational at 75 Mbpd. An additional 75-Mbpd fractionator, MB-3, will be up and running by the end of 2014.

Targa Resources. Targa Resources operates the Cedar Bayou fractionator, a 253-Mbpd plant that is undergoing a 100-Mbpd expansion that is expected to be completed by mid-2016.

Gulf Coast Fractionators is a JV between Phillips 66 and Devon Energy. The single fractionation train in Mont Belvieu produces 145 Mbpd of NGL.

Lone Star NGL. Energy Transfer Partners and Regency Energy operate two 100-Mbpd fractionators in Mont Belvieu under the JV Lone Star NGL. Both facilities were newbuilds.

Storage. After fractionation, the component molecules must move to a suitable outlet—storage for later usage, delivery to a chemical plant or other facility, or pipeline to market.

Since NGL are in gaseous form under normal atmospheric pressure, storage must be pressurized, and most underground storage assets are located near fractionation facilities, such as in Mont Belvieu and Conway, Kansas. The primary form of NGL storage, for both Y-grade and purity products, occurs in underground salt caverns.

Aboveground and belowground pipeline networks carry product from the fractionators to underground storage locations. From there, the NGL are further distributed to market. Salt domes are common along the USGC, and Mont Belvieu is a particularly unique zone in that its extensive underground salt cavern structures have enabled the mass storage of purity products and raw NGL.

Just as the Cushing, Oklahoma hub is a benchmark for WTI crude oil, the numerous interests and companies operating within the boundaries of Mont Belvieu make it the Western Hemisphere’s NGL pricing and trading hub.

Domestic outlets. The current picture for US-produced NGL is similar to that for refined products, in that domestic demand is not able to keep up with produced supply. The EIA estimates that approximately 200 Mbpd to 400 Mbpd of ethane are rejected.

However, the US chemical industry has responded with several steam cracker expansions, and companies are also looking offshore to secure markets for NGL components. The ethane surplus is expected to be soaked up by the new US cracker capacity being planned and constructed. Most of this capacity is scheduled to be completed in 2017, with the majority of the crackers located along or near the USGC. Additional production is expected to be exported. According to RBN Energy LLC, the new ethane demand would be considerable: 105.5 Mbpd of ethane intake by the end of 2015, and another 495 Mbpd from 2017–2019.

Export outlets. As increasing supplies of ethane find outlets on the domestic side, US-produced NGL are also expanding significantly at the export level.

According to the EIA, the US exported 309 Mbpd of propane in 2013, more than triple the amount in 2010 and significantly more than the average of 37 Mbpd exported in 2003. By comparison, the US imported, on average, around 200 Mbpd prior to that time.

According to RBN Energy, exports of LPG from the US to international markets are expected to nearly double from 466 Mbpd in 2014 to 825 Mbpd in 2018, as production from gas plant processing exceeds domestic demand.

Since the start of 2013, Enterprise Products Partners has twice upgraded its marine export facilities at the Houston Ship Channel, which is directly connected to Mont Belvieu via dedicated pipelines. The company operates around 7.5 MMbbl/month of LPG export capacity, a figure that continues to rise. By the end of the first quarter of 2015, around 9 MMbbl/month will be available for export. By the end of 2015, the volume will rise to approximately 16 MMbbl/month.

Enterprise is not limiting its export scope to just propane and butane, however; ethane and condensate are also in its target. Enterprise is expected to complete its ethane export terminal on the Houston Ship Channel by 2016, targeting foreign importers. The low boiling point of ethane (−128°F) makes its transport a sophisticated and costly process in comparison to oil products.

Targa Resources commissioned the first phase of its LPG export project in September 2013, bringing capacity to approximately 3.5 MMbbl/month of propane. The company’s second phase, expected to be finished by the third quarter of this year, will add an additional 2 MMbbl/month of capacity.

Other US NGL hubs

Although much of the focus on the US NGL market is in Mont Belvieu, Texas, there are other notable regions of interest.

Bushton and Conway, Kansas. Located in the heart of the Midwest is another key NGL production and storage facility. While not as large as Mont Belvieu, Bushton and Conway serve as the hub for the Midwest, feeding much of the region’s need for agricultural crop drying and residential heating.

Williams operates a fractionator with 100 Mbpd of capacity and storage of up to 21 MMbbl. ONEOK is the other major operator in the area, with a 193-Mbpd fractionator and storage totaling 26.4 MMbbl. ONEOK’s Bushton fractionator underwent a 60-Mbpd expansion in September 2012.

Appalachian region. Shale drilling in the Marcellus and Utica shale plays has also unlocked vast swaths of the region’s hydrocarbon potential.

West Virginia and Pennsylvania are playing an increasingly larger role in the production of NGL. Sunoco Logistics’ Mariner West pipeline is sending approximately 24 Mbpd of Marcellus ethane from southwestern Pennsylvania to Nova Chemicals’ petrochemical complex near Sarnia, Ontario, Canada. Its Mariner East project will deliver propane and ethane from the liquids-rich Marcellus shale areas in western Pennsylvania to Nova’s Philadelphia, Pennsylvania facility. From there, ethane and propane will be processed, stored and distributed to various domestic and waterborne markets. The project will have the capacity to transport approximately 70 Mbpd of NGL, with potential for expansion.

The Mariner East pipeline will carry propane by the second half of 2014, and it is expected to be fully operational to deliver propane and ethane in the first half of 2015.

In June 2012, Shell announced plans to assess the building of a world-scale petrochemical complex in Beaver County near Monaca, Pennsylvania. While the company has not yet broken ground, the project has amassed interest. GP

Steven McGinn is a former NGL broker with Blue Ocean Brokerage and a former price reporter at ICIS and Platts. He holds editorial and technical sales experience in the upstream and downstream sectors, and he is a graduate of Sam Houston State University. Mr. McGinn is based in Houston, Texas.

Comments