The European countries most impacted by Russian gas phase-out

The European Union's plans to phase out Russian natural gas imports by 2027 will impact some member nations more than others, due to wide country variance in gas dependence and differing abilities to switch suppliers to other origins.

Some countries - including Hungary and Slovakia - are weighing legal action against the EU as their economies are highly dependent on gas for power and industry and can't benefit from LNG imports as they are landlocked.

More opposition as well as further refining of the final plan can be expected over the coming months, which EU authorities hope to pass legislation on in early 2026.

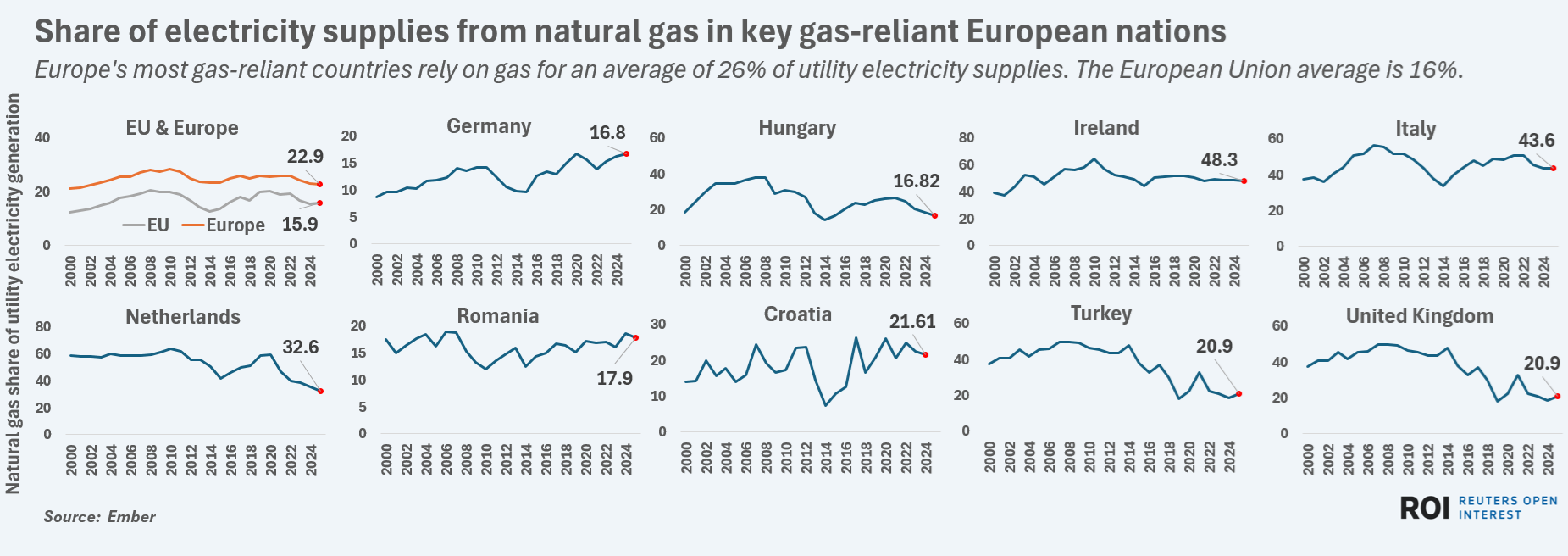

To help outline potential grounds for dispute among impacted countries, below is a breakdown of Europe's most gas-dependent nations and key regional gas import trends.

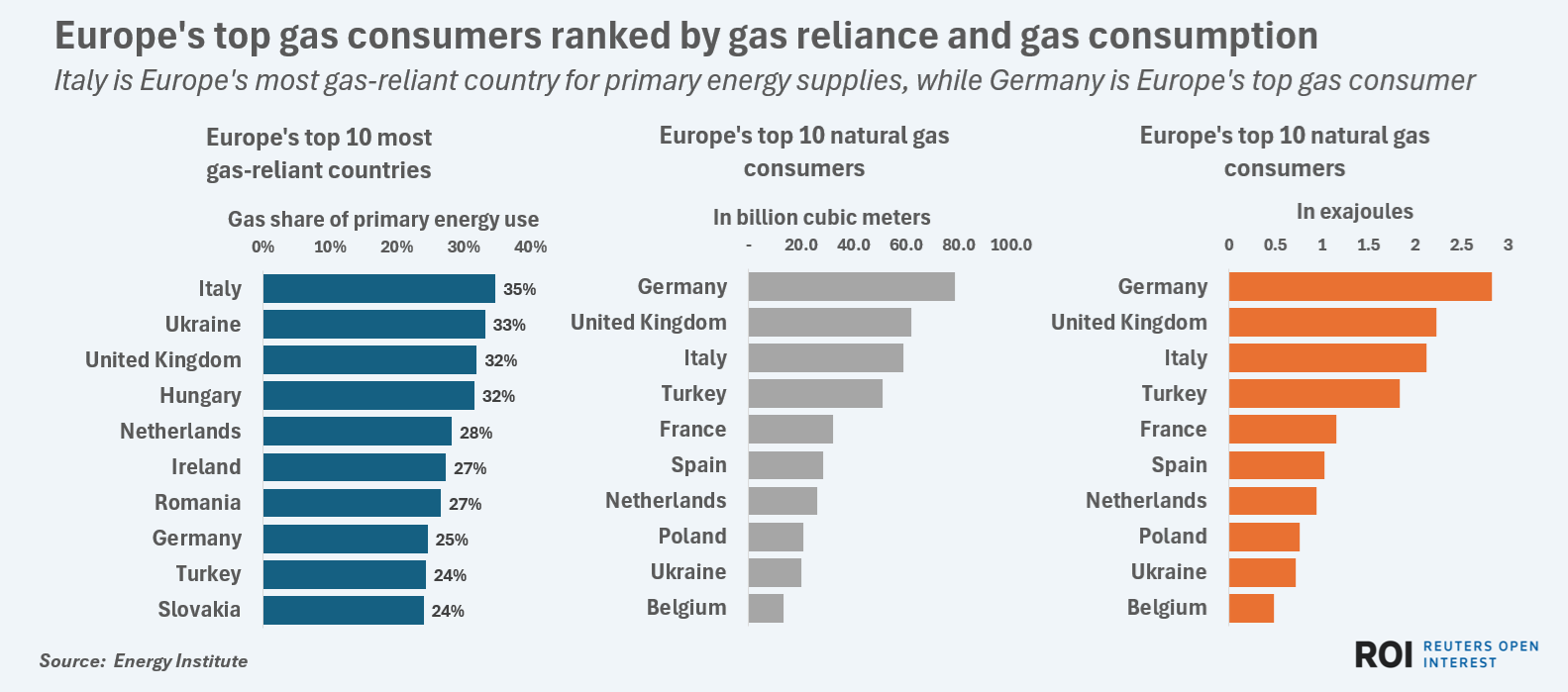

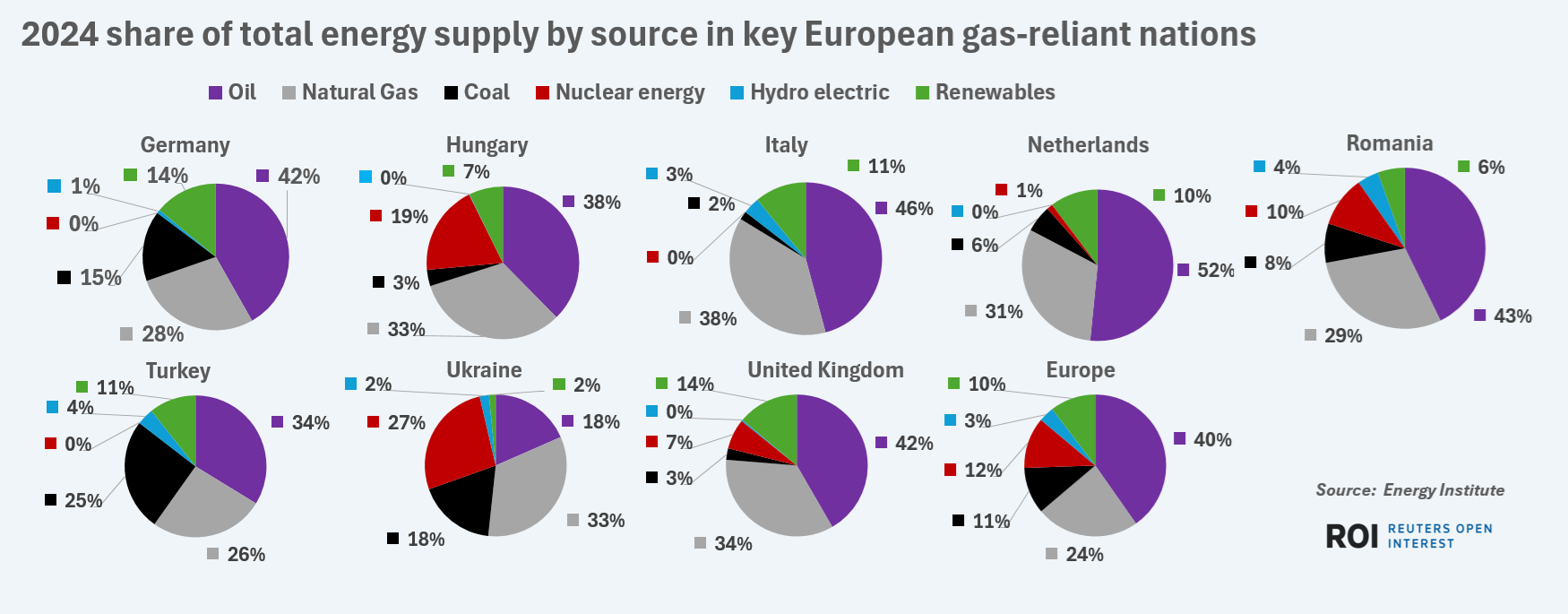

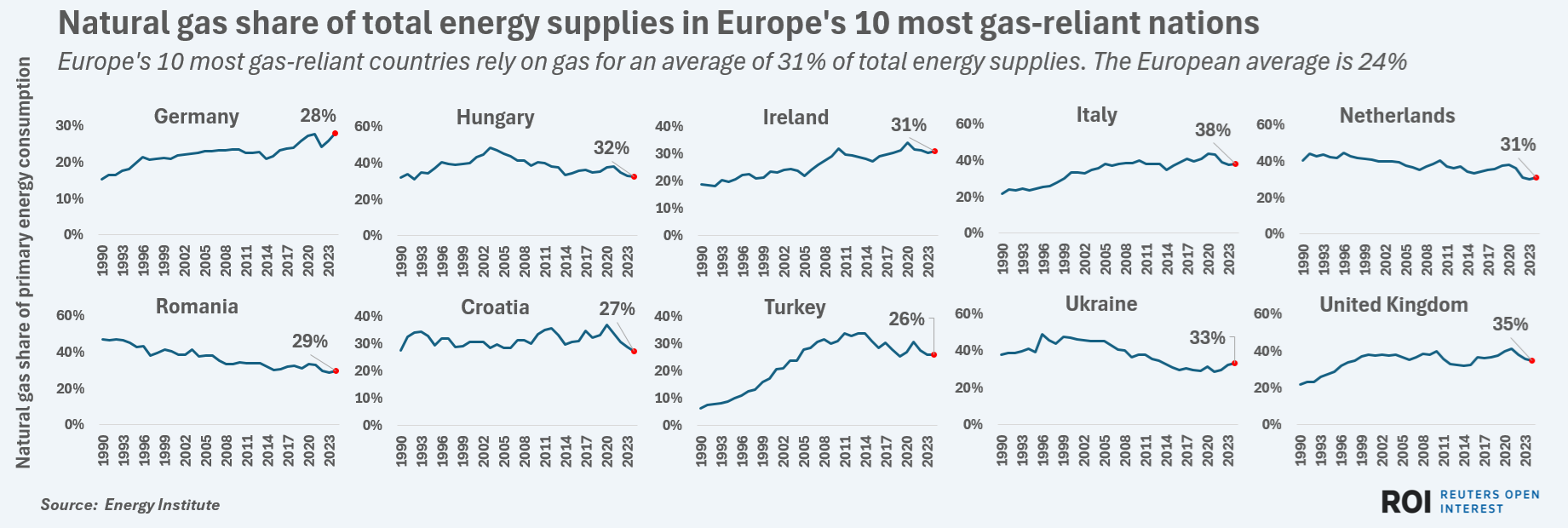

Total energy needs. Some countries are more gas-dependent than others.

For instance, while Germany is by far the continent's largest natural gas consumer, it ranks eighth in the region in terms of natural gas's share in its total energy supplies.

Italy is Europe's most gas-reliant economy, with 38% of its total energy supplies sourced from natural gas in 2024, according to data from the Energy Institute.

The United Kingdom, Ukraine, Hungary and the Netherlands round out the top five most gas-reliant nations in terms of gas's share of the total energy supply mix.

Altogether, six major European countries rely on natural gas for 30% or more of total energy supplies, which justifies the pushback against policies that threaten to cut those supplies and impede power output and industrial activity.

Switch-out ease. That said, among Europe's 10 most gas-dependent economies in terms of total energy supplies, nine have direct access to major ports that in theory could enable imports of liquefied natural gas.

Only Hungary - which is totally landlocked - lacks a seaport to build an LNG import terminal, which partly explains why the country is so opposed to the EU diktat to phase out gas imports from Russia.

Slovakia, which relies on gas for roughly a quarter of its energy supplies, faces similar geographic constraints to Hungary and so has felt compelled to join Hungary in resisting the EU plan.

Other heavy gas users in Central Europe, including Croatia, Austria and Romania, face similar challenges in economically accessing non-Russian gas supplies given the distances to import terminals and limited pipeline connections to other exporters.

Premium LNG. Even those countries with ample LNG import terminals face a challenge in economically switching out Russian gas.

While Russian gas was rarely supplied at bargain-basement prices, it does cost far less than imported LNG. Prices tend to vary over time, and exporters of both Russian gas and U.S. LNG tend to keep the details closely guarded.

Even so, industry estimates have previously placed Russian pipeline supplies at around $6 to $8 per million British thermal units (MMBtu). In contrast, prices for LNG imported into Europe have been reported in the $12 to $15/MMBtu range, so can be roughly 50% more than Russian pipelined supplies.

That said, stiff competition among LNG exporters has resulted in a downturn in LNG prices in the European market in recent months, which has likely narrowed the pipeline-LNG price spread for current buyers.

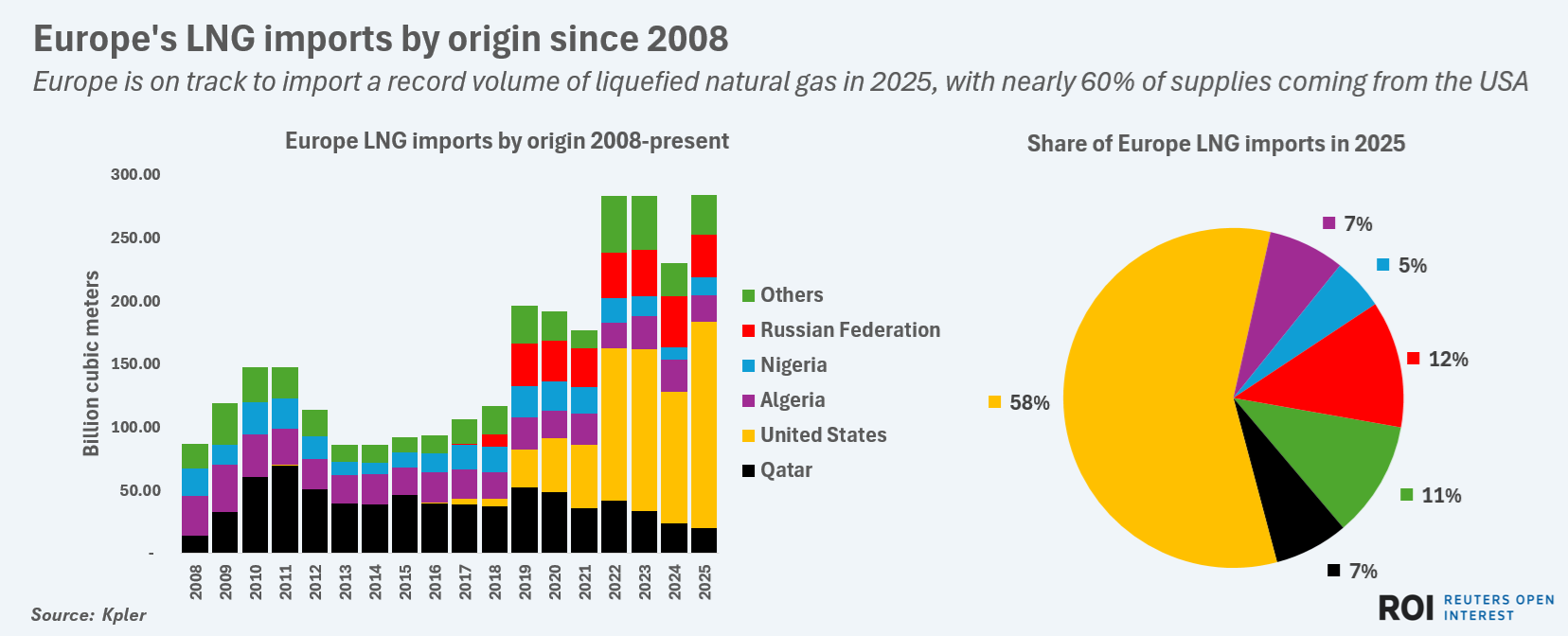

Long-term solution? If European countries are to permanently displace Russian pipeline supplies, the region must remain a hefty regular importer of LNG.

So far in 2025, European LNG imports have topped 284 Bm3, according to Kpler, which is a record and marks a 23% rise from 2024's import total.

Such a strong rise in annual import needs has boosted sentiment among LNG exporters, many of whom plan to add LNG export capacity over the coming years on the assumption that LNG import demand will keep growing.

However, this year's import tally is only 0.3% greater than Europe's import total in 2023 - the previous annual peak - and so raises questions over the durability of the current LNG import spree.

The rapid growth in power generation from non-fossil fuel sources over the past five years or so is also threatening to limit Europe's demand for gas in generation mixes.

Generation of clean electricity has increased by over 11% in Europe since 2019, while generation from fossil fuel sources has declined by 15%, data from Ember shows.

A continuation of both those trends over the coming decade - which is planned by most European economies - would limit the overall growth potential for LNG imports into Europe, even if all Russian supplies are phased out as planned.

For the near term, however, gas retains a crucial role across Europe in both electricity production and for industrial processes.

As a result, even in the face of social and government pressure to cut purchases from Russia, several utilities and businesses across Europe will remain heavily reliant on gas for daily operations and will resist being forced to go without.

The opinions expressed here are those of Gavin Maguire, a columnist for Reuters.

Related News

Related News

- Freeport LNG export plant in Texas to take in more natgas after unit shut on Monday

- Aramco's Jafurah gas plant (Phase 1) begins output

- U.S. natural gas prices surge 4% to 35-month high in cold snap

- LNG cool-down vessel arrives at ExxonMobil's Golden Pass plant in Texas

- Freeport LNG export plant in Texas reports shutdown of liquefaction train

Comments