Floating LNG market overview: Has FLNG crested the wave?

L. Kelleher, Wood Mackenzie, London, UK

Following the oil price crash in 2014, coupled with the view of an oversupplied LNG market, sanctioned volumes of new LNG supply dropped considerably between 2015 and 2017. However, throughout these stagnant years, FLNG was a bright spot in the market.

The first FLNG cargo was shipped in 2017. Three FLNG vessels are now operational: Petronas’ PFLNG Satu, Golar LNG’s Cameroon FLNG and Shell’s Prelude. Of the seven major LNG projects sanctioned between 2015 and 2018, three were FLNG projects: Cameroon FLNG, Eni’s Coral FLNG and BP’s Tortue FLNG.

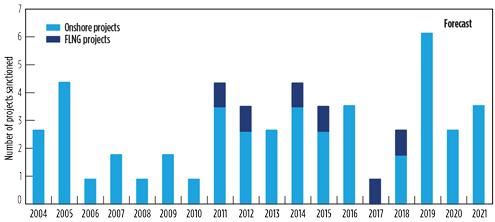

In a world requiring tight capital discipline, FLNG offers lower capital investment and manageable costs. Faster construction times provide early cashflows to support further development. Evidence of this was seen by the final investment decisions (FIDs) taken on Coral FLNG (Mozambique) in 2017 and Tortue FLNG (offshore Mauritania and Senegal) in 2018. Both projects are the first LNG facilities in a frontier region with further expansions set to follow. Despite this success, the outlook for further FLNG FIDs is quiet (Fig. 1).

|

|

FIG. 1. Number of LNG projects sanctioned by year. FLNG enjoyed success following the crash in 2014, but the FID outlook is quiet. |

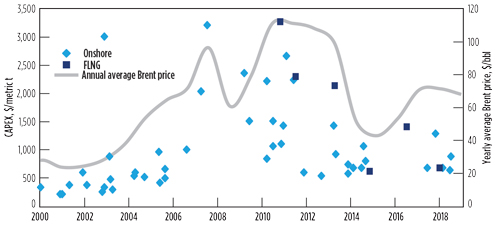

A costly learning experience. The higher oil prices seen between 2008 and 2014, which peaked at $147/bbl for Brent, caused a major escalation in oil and gas project costs. A number of high-cost Australian LNG projects were sanctioned, including Prelude, an FLNG vessel with a liquefaction capacity of 3.6 metric MMtpy.

Prelude’s project costs surpassed $12 B, resulting in a cost of more than $3,200/metric t of LNG produced, making it the most expensive LNG project ever (on a cost-per-metric-t basis). Australian projects average $2,400/metric t of LNG output overall, which is substantially higher than the global average of $1,000/metric t.

However, FLNG projects elsewhere were also subject to major cost overruns. In Malaysia, Petronas’ PFLNG Satu, with a capacity of 1.5 metric MMtpy, cost $2,300/metric t. Petronas also ordered another vessel (PFLNG Dua), at an estimated $2,200/metric t. Yet, following the oil price crash in 2014, the costs of both LNG and FLNG projects have decreased substantially due to lower service costs and standardization of materials and engineering (Fig. 2).

|

|

FIG. 2. CAPEX ($/metric t) of LNG facilities by FID date with yearly Brent oil price ($/bbl), in real 2018 prices. |

In the early 2000s, a forecast US gas shortage resulted in the construction of a number of LNG import terminals on the US Gulf Coast. These import terminals were built with berthing facilities for LNG tankers, as well as LNG storage tanks. While the shale gas boom in the US made these facilities obsolete, companies such as Cheniere spotted an opportunity for export. Conversion of these LNG import terminals to enable export has made them cheaper (averaging $650/metric t) than competing global LNG projects.

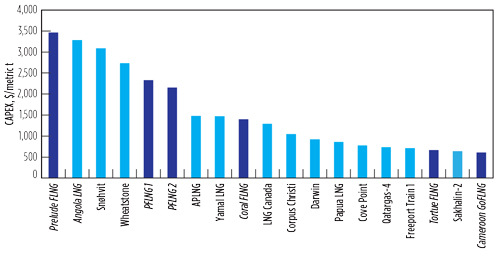

These projects have also benefited from low processing requirements, taking preprocessed gas from the grid. FLNG aims to follow suit, offering lower-cost solutions; Cameroon FLNG and Tortue FLNG carry liquefaction costs of $650/metric t. However, the drop in price of these vessels is also a result of a change in offering (Fig. 3).

|

|

FIG. 3. CAPEX ($/metric t) of a selection of both onshore and FLNG vessels, in real 2018 prices. |

Apples and oranges: open-sea FLNG vs. nearshore. Two FLNG concepts are in use: open-sea and nearshore. Open-sea FLNG is used to develop stranded gas fields that may be considered uneconomical because they are small, or that lie some distance from shore or existing infrastructure.

Nearshore can be used for fast-tracking, either as an alternative to an onshore plant or in sensitive locations, or even as an interim solution while conventional onshore facilities are under evaluation. These vessels do not require a deepwater mooring turret or the motion control of an open-sea vessel.

Processing requirements. Open-sea vessels sanctioned to date—including Prelude, Coral FLNG, PFLNG Satu and PFLNG Dua—are designed to take feed gas directly from the reservoir via subsea developments onto the vessel. Therefore, these vessels require the stringent equipment and safety features of an upstream development. Feed gas into the Prelude vessel contains reasonable quantities of condensate, hydrogen sulfide and carbon dioxide, adding to processing equipment requirements. Condensate is stored within the vessel’s hull, alongside LNG and LPG. All these factors added to the considerable size and cost of the vessel.

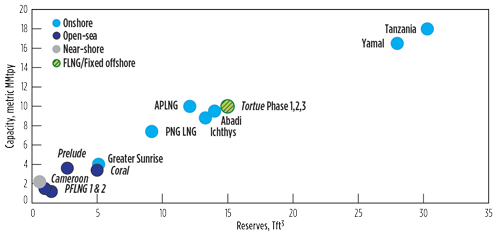

Conversely, nearshore projects take preprocessed gas and liquefy it. Separators and high-pressure protection systems, like those seen in upstream developments, are not required. In essence, nearshore projects are midstream developments. However, while such a concept can improve economics relative to an open-sea vessel, it still cannot compete with the economics of onshore liquefaction (Fig. 4). For example, BP will move away from FLNG in the subsequent phases of the Tortue FLNG development, while Eni and ExxonMobil are planning onshore developments in Mozambique after Coral FLNG. A major reason for these decisions is scale.

|

|

FIG. 4. Capacity (metric MMtpy) of LNG facilities vs. reserves. Capacities greater than 4 metric MMtpy benefit from onshore development. |

Scaling up is hard to do. The largest-capacity FLNG vessel built to date is Prelude at 3.6 metric MMtpy. Globally, the average size of an onshore liquefaction facility is 8 metric MMtpy. To compete with onshore liquefaction, FLNG projects must add another vessel to a development. Each vessel requires its own storage and offloading facilities. Onshore projects, on the other hand, can share storage facilities between additional trains and do not need extra berthing capacity. FLNG lacks that economy of scale.

Some projects seek to challenge this scale problem—Delfin FLNG, for example. The project proposal includes four vessels (each with a 3-metric-MMtpy capacity) totaling 12 metric MMtpy. However, the project remains speculative at this stage.

All else being equal, fields with gas resources of greater than 5 Tft3 have improved project economics with liquefaction capacities of greater than 4 metric MMtpy. Otherwise, a long and low production profile will be hit by economic discounting. With FLNG’s lack of economy of scale beyond 4 metric MMtpy, fields greater than 5 Tft3 tend to be developed onshore. New onshore projects being proposed in Mozambique, Russia, Qatar and the US have capacities of greater than 10 metric MMtpy.

Some projects fall on the tipping point of onshore or FLNG development, such as Greater Sunrise, offshore Timor Leste/Australia. While initial plans envisaged an FLNG development, the Timor Leste government stipulated that the project needed to include an onshore processing plant.

Governments pull projects onshore. The Greater Sunrise experience is not an isolated one. The Abadi gas project in Indonesia was being primed for an FLNG development. However, the Indonesian government has voiced strong support for an onshore development, which is likely to be approved. Similarly, in Tanzania, the government stipulated that liquefaction must be onshore, adding to the challenges in its path to FID.

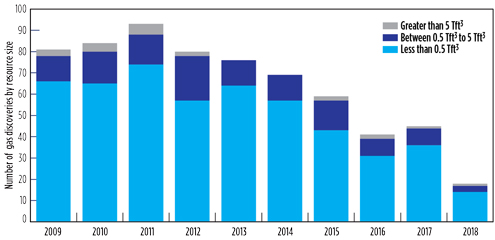

A dwindling number of new gas finds. FLNG faces another problem. The majority of gas discoveries globally are less than 0.5 Tft3 in resource size, making FLNG uneconomic, while fields with a resource size greater than 5 Tft3 tend to inspire onshore developments. The number of discoveries within this resource band has dwindled considerably since 2012, in line with a falling number of discoveries overall (Fig. 5).

|

|

FIG. 5. Number of gas discoveries by size and by year. |

The downturn in oil prices in late 2014 also resulted in a significant reduction of exploration budgets. On top of this, companies are focusing on infrastructure-led exploration in mature basins to increase the probability of success and reduce development costs. The low number of new gas discoveries globally and the abundance of shale gas in the US have contributed to the quiet FID outlook for future FLNG developments.

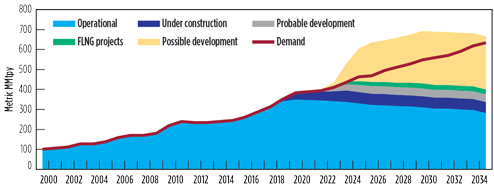

FID outlook: Busy times for LNG ahead, a quiet outlook for FLNG. Rising demand in Asia and diversification of supply in Europe have given LNG a confidence boost. With demand on course to exceed supply by the mid-2020s, FIDs could be taken for dozens of onshore LNG projects in the coming years, with the intention of filling the supply gap.

Many of these proposed projects are high-capacity (> 10 metric MMtpy), offering lower-cost (< $1,000/metric t) developments with which some FLNG proposals will struggle to compete. FLNG accounts for 2% of global LNG supply, and even in a high-case scenario is unlikely to account for more than 4% of future supply (Fig. 6).

|

|

FIG. 6. A large number of onshore projects could help meet a forecast supply gap in the 2020s. FLNG will make up less than 4% of LNG supply. |

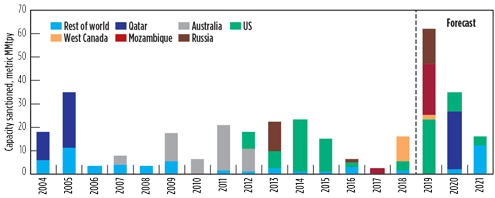

Wood Mackenzie’s FID outlook sees high-capacity projects (> 10 metric MMtpy) in the US, Mozambique, Russia and Qatar as those best positioned to fill the supply gap. Both small- and large-scale FLNG projects are struggling to attract financing, partners and buyers in a busy marketplace (Fig. 7).

|

|

FIG. 7. Forecast for sanctioned capacity (both onshore and FLNG). This year is set to be the highest on record for project sanctions. |

However, as the FLNG sector matures due to technological innovation and greater experience, costs are likely to decrease. The concept’s low environmental impact and potentially shorter construction timelines can be used to fast-track projects to FID and first production. New projects could appear quickly, as happened with Tortue FLNG.

Furthermore, the advantages of FLNG are being incorporated into a new type of development concept—fixed offshore liquefaction. Arctic LNG 2 and Tortue FLNG Phases 2 and 3 will use gravity-based structures or jackets in their development plans, utilizing the advantages of offshore modular construction but avoiding some of the difficulties of floating liquefaction.

FLNG has taken a giant leap in confidence recently, but it may now need to make smaller, progressive steps as it competes for capital and buyers in a bustling LNG market. GP

|

Liam Kelleher is a gas and LNG analyst with Wood Mackenzie. He previously worked as a reservoir engineer with ConocoPhillips and a project engineer with Wood Group. He holds an MSc degree in petroleum engineering from Imperial College in London, UK.

Comments