Challenges facing GTL: Rethinking project economics in 2018 and beyond

Natural gas is growing in importance worldwide and is now making up a larger portion of oil companies’ reserves. This trend is driven by discoveries of large gas volumes internationally (e.g., East Africa, West Africa, Eastern Mediterranean), along with the US shale gas revolution, which has enabled large volumes of gas production and turned the US into one of the biggest gas producers worldwide.

Many companies and host nations are looking at ways to monetize these recently discovered gas reserves. On the demand side, gas is widely viewed as the fuel of choice for many countries, especially in the power generation industry. Also, the growing global economy has encouraged an increase in gas demand for LNG and in the petrochemical industry, such as using natural gas for the production of methanol.

In parallel to these changes in gas production and demand, oil prices have been increasing steadily over the past 2 yr and have more than doubled since 1Q 2016. As crude prices rise, petroleum product prices rise in tandem. Under normal circumstances, with higher product prices and relatively cheap, plentiful natural gas supplies, announcement of new GTL projects would be expected. The authors have seen increased interest in GTL projects, and a number of feasibility studies have been conducted in the past few years.

However, despite these favorable dynamics, we have not seen any publicized final investment decisions (FIDs) for new, large-scale GTL projects. Here, we analyze the potential for GTL projects, evaluate present and future project economics, and discuss the reasons for this lack of activity in the GTL space.

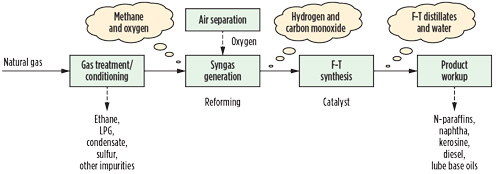

Background on GTL projects. GTL is the conversion of natural gas into liquid products via reforming, synthesis and upgrading processes. The typical GTL product mix focuses on transportation fuels, primarily kerosine and diesel. The GTL production process is shown in Fig. 1.

|

|

Fig. 1. Schematic of the GTL production process. |

GTL technology has four main components:

1. Feedstock preparation

- Natural gas treatment

- Air separation to supply oxygen, although some plants make syngas (CO + H2) without oxygen

2. Syngas production using catalytic reactors

3. Fischer-Tropsch (F-T) catalytic process to convert syngas into liquids

4. Liquid refining and separation.

The GTL plant has two main catalytic processes:

- Syngas generation, which can be from coal (e.g., Sasol’s coal-to-liquids plant in South Africa), but more commonly uses natural gas as the feedstock to make syngas

- The F-T process, originally developed in Germany in the early part of the 20th century to convert coal and lignite to liquid petroleum products.

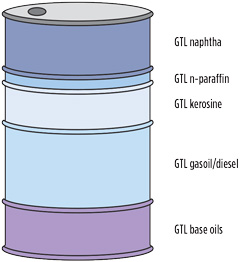

GTL products from a typical large-scale GTL plant are graphically represented in Fig. 2.

|

Demand for GTL products and project economics. Demand for GTL products is healthy. Diesel consumption is increasing, especially in developing economies in Asia and Africa.

GTL naphtha, which is free of sulfur, is in demand. Waxes for the lubes business are also sought after due to their high quality.

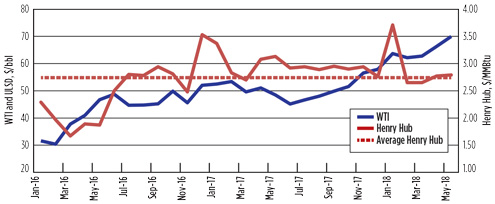

Since the trough in oil prices in 1Q 2016, both crude and petroleum product prices have gone up in value, while natural gas prices have remained fairly low. Fig. 3 shows the rise in crude oil prices vs. Henry Hub (HH) gas prices, with the latter showing an average of $2.74/MMBtu over the period.

|

|

Fig. 3. Rise in crude oil prices vs. Henry Hub gas prices, January 2018–May 2018. |

Despite these favorable pricing trends, investments in new large-scale GTL projects have not emerged. To analyze potential project drivers, the authors used an in-house GTL economics model, along with in-house crude and product price forecast models. Setting a 15% internal rate of return (IRR) as a hurdle rate and an indicator for investment-grade projects, the authors examined three key variables and their impact on present and future GTL project returns.

Crude oil prices. Generally, changes in crude prices cause a direct change in GTL product prices, although the lower-volume/higher-priced wax and lube products often lag crude price movements by many months. The model was initially run using 2015 average prices, where West Texas Intermediate (WTI) crude was approximately $52.35/bbl and HH gas was $2.60/MMBtu, and a 50-Mbpd GTL plant generated an IRR of only 4.3%. Using 2018 year-to-date prices, where WTI crude is approximately $66.70/bbl and HH gas is approximately $3/MMBtu, the calculated IRR increases to 7.7%.

While the effect of higher market prices for crude has increased project economics, the returns remain well below investment grade. To determine the impact of crude price on project returns, HH gas was fixed at $3/MMBtu and crude prices were escalated in line with the authors’ in-house crude and product price forecasts. When the forecast crude price (and the associated product prices) reached approximately $97/bbl, the calculated IRR rose to 15.2%, becoming equivalent with the investment-grade target.

Further sensitivity analysis indicates that, for every $5/bbl increase in crude price, the calculated IRR improves by approximately 1.1%. Potential GTL investors need both sustained high oil prices close to $100/bbl and a substantial differential between oil product prices and gas prices to make GTL project economics attractive.

Feedstock prices. The authors carried out a number of sensitivities using HH gas prices. Initially, the HH gas price was dropped to $2/MMBtu and the crude price was varied as explained previously. In all cases, project IRR improved by approximately 1.8%, reaching 17% with crude at $97/bbl. Gas prices were then increased to $4/MMBtu, and the calculated project IRR declined by approximately 1.8% in all cases.

These calculations indicate that low gas prices, as typified by stranded gas assets, are needed throughout the project life to enhance the economics. Escalating gas prices have a significant negative impact on calculated project economics. For example, the increasing US LNG export volumes could put pressure on gas prices, introducing project uncertainties.

Project costs (CAPEX and OPEX). The capital cost of a typical 50-Mbpd GTL plant is approximately $5 B; this figure was decreased by 20% for each of the cases studied, representing real engineering and procurement progression. This adjustment improved the project IRR by approximately 4.3% (for the $97/bbl WTI and $3/MMBtu HH gas case, the calculated project IRR increased to 19.5%). Reducing the OPEX by 20% over the life of the project has a marginal impact on the calculated IRR, increasing it by approximately 0.2%.

Key challenges and potential way forward. Despite higher oil prices, which improve GTL project economics, why has GTL not taken off as expected? The challenges of project economics and the sensitivities around crude oil and feedstock prices have been explained. However, large-scale GTL projects face a number of other challenges:

- Shortage of project finance facilities for CAPEX-intensive energy projects

- Few EPC contractors can handle projects of this size, resulting in a lack of competition

- Massive capital investment; Shell’s Pearl GTL project reportedly cost $20 B

- Significant gas volumes are needed: 0.5 Bft3d of gas for a 50-Mbpd GTL plant

- Limited number of players in the GTL technology business

- GTL plants have proven to be operationally complex.

Overcoming these challenges will require a combination of sustained high oil prices in the $90/bbl–$100/bbl range, low gas prices and a significant drop in project costs. The absence of recent synchronicity of these elements explains why large-scale GTL projects have not been sanctioned in recent years.

However, the authors do not think that crude and product price increases are the only solution. Movement is seen toward mini-GTL technology—plants with capacities of 100 bpd–1,000 bpd. Mini-GTL plants can be used for isolated gas monetization and flare reduction. They are less complex than large-scale facilities, and some technology providers have modified their catalysts to maximize diesel production and avoid wax handling issues.

Mini-GTL opportunities. The mini-GTL concept has existed for many years and is ideally placed to monetize stranded gas volumes, such as flared gas from a remote asset. While the industry has historically focused on large-scale GTL projects using F-T technology, new technologies associated with mini-GTL projects could prove to be both economically and technologically attractive.

As previously discussed, the hurdle rate for GTL projects in this price environment can be dramatically affected by reductions in CAPEX. The new technologies associated with mini-GTL directly attack the high-CAPEX issues. Specifically, technology developers are focusing on reducing CAPEX with changes in the “front end” of the project (i.e., syngas production) and the reduction or elimination of wax production. Claims of CAPEX reductions of 10%/bbl–20%/bbl of product, compared to a large-scale GTL plant, are being made by mini-GTL technology firms.

The claims of reductions in CAPEX are partly the result of the development of a new generation of catalysts. These proprietary catalysts provide higher production of diesel, naphtha and gasoline, while reducing or totally eliminating wax production. With no GTL wax production, the post-production unit to separate, process and store wax products can be eliminated, thereby dramatically reducing CAPEX costs. The elimination of wax production from the GTL process has the added advantage of reducing the overall complexity of the equipment, another factor that makes mini-GTL suitable for the monetization of flared gas in remote locations. In such areas, production of gasoline and diesel—products that can be used locally—is preferred over output of other products derived from conventional GTL projects.

The authors believe that mini-GTL technology may provide some unique advantages, given its lower CAPEX, simpler operations, focused product slate and ability to meet investment criteria in the present price environment.

Takeaway. Increases in crude oil prices have certainly helped GTL economics, but this may not be sufficient for the approval of large-scale projects, given the complex dynamics involved. A significant drop in project CAPEX, sustained low gas prices and further appreciation in crude prices are needed to turn the tide.

In response, the industry has taken steps to reduce project CAPEX and improve the yield of high-value products. Despite these changes, the relatively high CAPEX requirement for large-scale GTL projects means that mini-GTL projects are more likely to be sanctioned in the near future. GP

|

Ramin Lakani is a Consultant in the energy sector with 28 yr of experience in upstream, midstream and downstream projects. He works for Muse, Stancil & Co., based in London. A Chartered Engineer, he holds a BEng degree in chemical engineering from University College London, an MSc degree in petroleum engineering from Imperial College London and an executive leadership certificate from Texas A&M Mays Business School.

|

Tim Bennett is a Principal Consultant at Muse, Stancil & Co.’s London office, where he has worked for more than 20 yr. He has completed a wide range of consulting assignments in the oil and gas sector in Europe, the former Soviet Union, Africa, the Middle East and Asia-Pacific. Mr. Bennett holds a BSc degree in chemical engineering from Loughborough University in the UK.

|

Ajey Chandra is a Director at Muse, Stancil & Co. and the Managing Partner of their Houston office, where he also leads the Midstream and Independent Engineering practice areas for the firm. He has more than 30 yr of experience in various facets of the energy industry and has had a wide variety of assignments in the US, Europe and Southeast Asia. He worked at Amoco, Purvin & Gertz, Hess and NextEra Energy Resources prior to joining Muse, Stancil & Co. Mr. Chandra is a registered Professional Engineer, and holds a BS degree in chemical engineering from Texas A&M University and an MBA degree from the University of Houston.

Comments